Stock

Mon 30 June 2025

# Block 1: Install required packages (if not already installed)

!pip install yfinance matplotlib --quiet

# Block 2: Import necessary libraries

import yfinance as yf

import matplotlib.pyplot as plt

import pandas as pd

# Block 3: Set display options for better visualization

pd.set_option("display.max_rows", 10)

pd.set_option("display.float_format", "{:.2f}".format)

# Block 4: Download historical stock data for Apple (AAPL)

stock = yf.Ticker("AAPL")

df = stock.history(period="1y")

df.head()

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2024-06-28 00:00:00-04:00 | 214.77 | 215.06 | 209.32 | 209.64 | 82542700 | 0.00 | 0.00 |

| 2024-07-01 00:00:00-04:00 | 211.10 | 216.50 | 210.93 | 215.74 | 60402900 | 0.00 | 0.00 |

| 2024-07-02 00:00:00-04:00 | 215.14 | 219.35 | 214.10 | 219.24 | 58046200 | 0.00 | 0.00 |

| 2024-07-03 00:00:00-04:00 | 218.98 | 220.52 | 218.01 | 220.52 | 37369800 | 0.00 | 0.00 |

| 2024-07-05 00:00:00-04:00 | 220.62 | 225.40 | 220.62 | 225.29 | 60412400 | 0.00 | 0.00 |

# Block 5: Basic Information

print("Company Info:")

stock.info['longBusinessSummary'][:300] + "..."

Company Info:

'Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising Ai...'

# Block 6: Describe the dataset

df.describe()

| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| count | 250.00 | 250.00 | 250.00 | 250.00 | 250.00 | 250.00 | 250.00 |

| mean | 222.36 | 224.92 | 220.02 | 222.67 | 53516737.60 | 0.00 | 0.00 |

| std | 15.69 | 15.12 | 15.96 | 15.61 | 27343853.63 | 0.03 | 0.00 |

| min | 171.72 | 190.09 | 168.99 | 172.19 | 23234700.00 | 0.00 | 0.00 |

| 25% | 211.19 | 214.02 | 209.38 | 212.35 | 39510475.00 | 0.00 | 0.00 |

| 50% | 224.17 | 226.07 | 222.23 | 224.21 | 46906700.00 | 0.00 | 0.00 |

| 75% | 232.45 | 234.26 | 229.18 | 232.52 | 58825975.00 | 0.00 | 0.00 |

| max | 257.57 | 259.47 | 257.01 | 258.40 | 318679900.00 | 0.26 | 0.00 |

# Block 7: Plot closing price

plt.figure(figsize=(12, 5))

plt.plot(df['Close'], label="Close Price", color='blue')

plt.title("Apple (AAPL) - Closing Price")

plt.xlabel("Date")

plt.ylabel("Price (USD)")

plt.legend()

plt.grid(True)

plt.show()

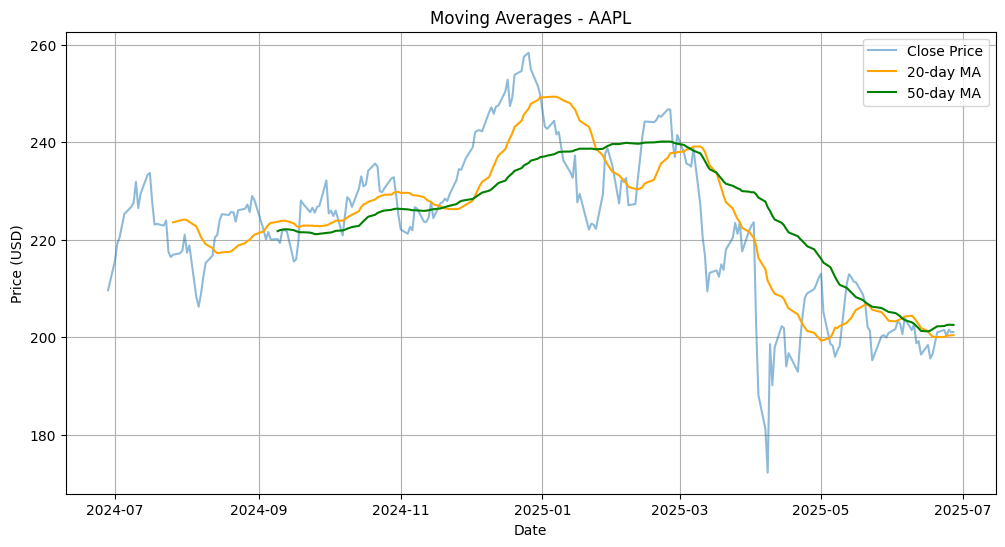

# Block 8: Calculate Moving Averages

df['MA20'] = df['Close'].rolling(window=20).mean()

df['MA50'] = df['Close'].rolling(window=50).mean()

df[['Close', 'MA20', 'MA50']].tail()

| Close | MA20 | MA50 | |

|---|---|---|---|

| Date | |||

| 2025-06-23 00:00:00-04:00 | 201.50 | 200.04 | 202.30 |

| 2025-06-24 00:00:00-04:00 | 200.30 | 200.29 | 202.50 |

| 2025-06-25 00:00:00-04:00 | 201.56 | 200.36 | 202.57 |

| 2025-06-26 00:00:00-04:00 | 201.00 | 200.38 | 202.55 |

| 2025-06-27 00:00:00-04:00 | 201.08 | 200.44 | 202.53 |

# Block 9: Plot Moving Averages

plt.figure(figsize=(12, 6))

plt.plot(df['Close'], label='Close Price', alpha=0.5)

plt.plot(df['MA20'], label='20-day MA', color='orange')

plt.plot(df['MA50'], label='50-day MA', color='green')

plt.title("Moving Averages - AAPL")

plt.xlabel("Date")

plt.ylabel("Price (USD)")

plt.legend()

plt.grid(True)

plt.show()

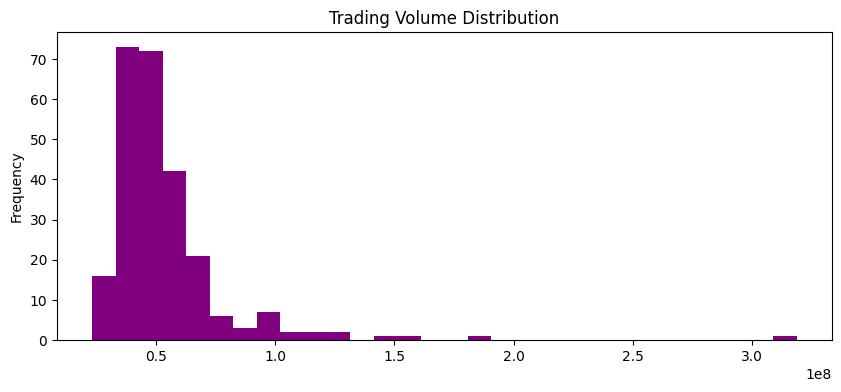

# Block 10: Volume analysis

df['Volume'].plot(kind='hist', bins=30, color='purple', figsize=(10, 4), title='Trading Volume Distribution')

<Axes: title={'center': 'Trading Volume Distribution'}, ylabel='Frequency'>

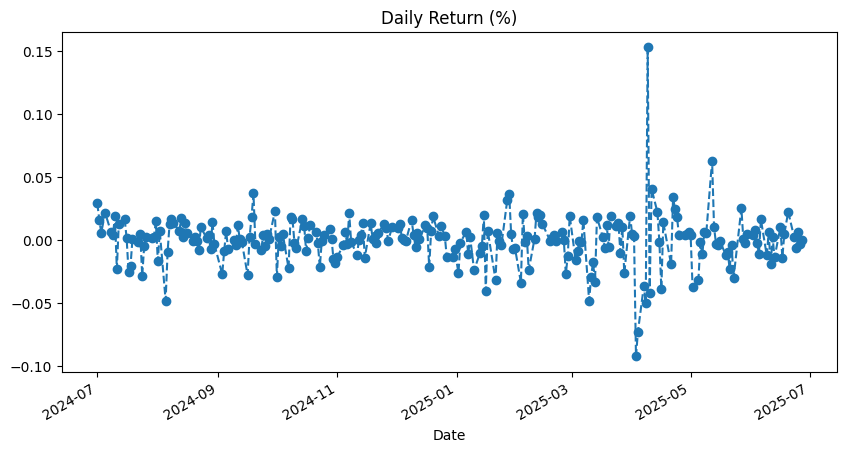

# Block 11: Daily Returns

df['Daily Return'] = df['Close'].pct_change()

df['Daily Return'].dropna().plot(figsize=(10, 5), linestyle='--', marker='o', title="Daily Return (%)")

<Axes: title={'center': 'Daily Return (%)'}, xlabel='Date'>

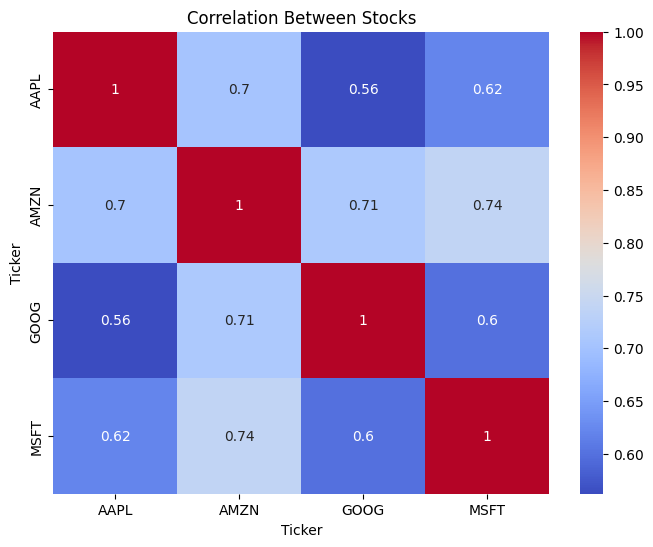

# Block 12: Correlation Matrix (simulate multiple stocks)

tickers = ['AAPL', 'MSFT', 'GOOG', 'AMZN']

df_multi = yf.download(tickers, period="6mo")['Close']

df_multi = df_multi.pct_change().dropna()

correlation = df_multi.corr()

correlation

C:\Users\HP\AppData\Local\Temp\ipykernel_6508\2024470801.py:3: FutureWarning: YF.download() has changed argument auto_adjust default to True

df_multi = yf.download(tickers, period="6mo")['Close']

[*********************100%***********************] 4 of 4 completed

| Ticker | AAPL | AMZN | GOOG | MSFT |

|---|---|---|---|---|

| Ticker | ||||

| AAPL | 1.00 | 0.70 | 0.56 | 0.62 |

| AMZN | 0.70 | 1.00 | 0.71 | 0.74 |

| GOOG | 0.56 | 0.71 | 1.00 | 0.60 |

| MSFT | 0.62 | 0.74 | 0.60 | 1.00 |

# Block 13: Heatmap of correlation

import seaborn as sns

plt.figure(figsize=(8, 6))

sns.heatmap(correlation, annot=True, cmap="coolwarm")

plt.title("Correlation Between Stocks")

Text(0.5, 1.0, 'Correlation Between Stocks')

# Block 14: Candlestick Chart (optional for advanced visuals)

!pip install plotly

Requirement already satisfied: plotly in c:\users\hp\miniconda3\envs\py312\lib\site-packages (6.2.0)

Requirement already satisfied: narwhals>=1.15.1 in c:\users\hp\miniconda3\envs\py312\lib\site-packages (from plotly) (1.44.0)

Requirement already satisfied: packaging in c:\users\hp\miniconda3\envs\py312\lib\site-packages (from plotly) (24.2)

import plotly.graph_objects as go

fig = go.Figure(data=[go.Candlestick(x=df.index,

open=df['Open'],

high=df['High'],

low=df['Low'],

close=df['Close'])])

fig.update_layout(title='Candlestick Chart - AAPL', xaxis_rangeslider_visible=False)

fig.show()

# Block 15: Highest closing price

highest = df['Close'].max()

print(f"Highest Closing Price in the Last 1 Year: ${highest:.2f}")

Highest Closing Price in the Last 1 Year: $258.40

# Block 16: Lowest closing price

lowest = df['Close'].min()

print(f"Lowest Closing Price in the Last 1 Year: ${lowest:.2f}")

Lowest Closing Price in the Last 1 Year: $172.19

# Block 17: Save processed data to CSV

df.to_csv("AAPL_Processed.csv")

print("Saved to AAPL_Processed.csv")

Saved to AAPL_Processed.csv

# Block 18: Display final data sample

df.tail()

| Open | High | Low | Close | Volume | Dividends | Stock Splits | MA20 | MA50 | Daily Return | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2025-06-23 00:00:00-04:00 | 201.63 | 202.30 | 198.96 | 201.50 | 55814300 | 0.00 | 0.00 | 200.04 | 202.30 | 0.00 |

| 2025-06-24 00:00:00-04:00 | 202.59 | 203.44 | 200.20 | 200.30 | 54064000 | 0.00 | 0.00 | 200.29 | 202.50 | -0.01 |

| 2025-06-25 00:00:00-04:00 | 201.45 | 203.67 | 200.62 | 201.56 | 39525700 | 0.00 | 0.00 | 200.36 | 202.57 | 0.01 |

| 2025-06-26 00:00:00-04:00 | 201.43 | 202.64 | 199.46 | 201.00 | 50799100 | 0.00 | 0.00 | 200.38 | 202.55 | -0.00 |

| 2025-06-27 00:00:00-04:00 | 201.89 | 203.22 | 200.00 | 201.08 | 73114100 | 0.00 | 0.00 | 200.44 | 202.53 | 0.00 |

Score: 20

Category: basics